Are you stuck with credit card debt that keeps growing? The Discover It Balance Transfer card could be your way out. It lets you move your debt and pay no interest for a while.

Plus, you might get a credit limit from $500 up to $10,000 or more. That means more room to breathe with your money.

The best part? Your credit limit can go up over time if you use the card wisely. Want to know how to get the highest limit possible and cut down your debt fast?

Let’s look at how the Discover It Balance Transfer credit limit works and how it can help you save money.

What are Discover it Balance Transfer Credit Limits?

The Discover It Balance Transfer card offers a range of credit limits to fit your needs. These limits start at $500 and can go up to $10,000 or more for some users.

Your credit limit depends on factors like your credit score, income, and how well you’ve managed money in the past. A higher credit score and income often lead to a higher limit.

The card’s balance transfer feature lets you move debt from other cards to your Discover card. This can help you save money on interest.

Remember, there’s a 5% fee for balance transfers. Your credit limit isn’t set in stone. Discover may increase it over time if you use the card responsibly.

This means paying on time and keeping your balance low. A higher limit can give you more flexibility and potentially boost your credit score.

What Affects Your Discover Balance Transfer Credit Limit?

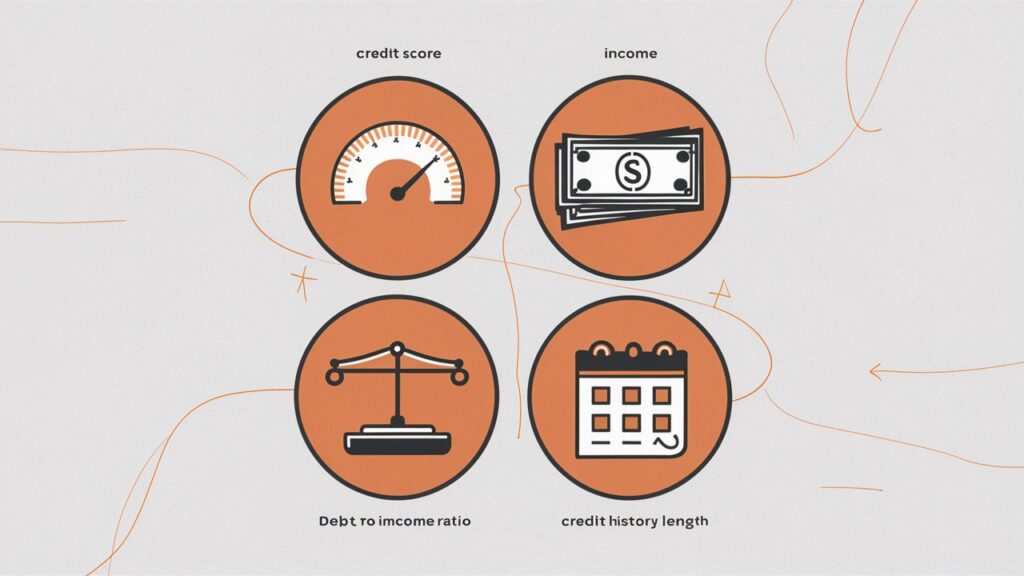

Your Discover It Balance Transfer credit limit depends on your money habits. Discover looks at several things to decide how much credit to give you. Let’s break down what matters most.

Credit Score: This number shows how well you handle credit. A higher score can lead to a higher limit. If you pay bills on time and don’t max out your cards, your score will likely be good. This could help you get a limit over $10,000.

Income: How much you earn counts. Discover wants to know you can pay back what you borrow. If you make more money, you might get a higher limit. But it’s not just about how much you make. They look at the big picture.

Debt-to-Income Ratio: This compares your debts to your income. If you make $5,000 a month and pay $1,000 for debts, your ratio is 20%. A lower ratio is better. It shows you have room in your budget for more credit.

Credit History: The longer you’ve had credit, the better. It lets Discover see how you’ve handled money over time. Five years of good credit use looks better than one year.

Benefits of Discover it Balance Transfer Credit Limits

The Discover It Balance Transfer card offers more than just a way to move debt. Its credit limit brings several benefits that can help your finances. Let’s look at how a good credit limit on this card can work for you.

Save Money

A higher limit means you can move more debt from other cards. This helps you save on interest during the 0% APR period.

For example, if you move $5,000 from a card with 20% APR, you could save $1,000 in interest over a year. That’s real money back in your pocket.

More Flexibility

Think of your credit limit as a financial cushion. A higher limit gives you more room to handle life’s ups and downs.

If your car needs a $1,000 repair, a higher limit means you can cover it without stress. Just remember to pay it off quickly to avoid interest.

Boost Your Credit Score

Your credit limit plays a role in your credit score. Using a small part of your limit is good for your score.

If you have a $10,000 limit and use $2,000, that’s only 20% use. This low credit utilization can help lift your score over time.

Earn More Rewards

Once you pay off your transferred balance, you can use the card for everyday spending. A higher limit lets you put more purchases on the card.

This means more cash back in your pocket. If you earn 1% on all purchases, a $10,000 limit could mean up to $100 cash back if you use it all.

These Discover card benefits show why a good credit limit matters. It’s not just about having more credit. It’s about having tools to manage your money better.

How Much Debt Can You Transfer With a Balance Transfer?

The amount of debt you can transfer with the Discover It Balance Transfer card depends on your credit limit. Let’s break this down and look at how it works.

Your credit limit sets the max for your balance transfer. If your limit is $5,000, that’s the most you can transfer. But there’s a catch. You need to factor in the balance transfer fee.

Discover charges a 5% fee for balance transfers. This fee gets added to your balance. Here’s how it plays out:

Say your credit limit is $10,000. You want to transfer $9,500 from another card. The 5% fee on $9,500 is $475. So your total transfer amount would be $9,975. This fits under your $10,000 limit.

But if you tried to transfer the full $10,000, it wouldn’t work. The fee would push you over your limit. The most you could transfer in this case is about $9,523. With the $476 fee, that brings you right up to your $10,000 limit.

Remember, your available credit matters too. If you’ve already used some of your credit limit, you’ll have less room for a balance transfer.

The key is to check your credit limit and do the math. This helps you know exactly how much debt you can move to your Discover card. By understanding these numbers, you can make the most of your balance transfer and save on interest.

| Credit Limit | $5,000 | $10,000 |

|---|---|---|

| Desired Transfer Amount | $4,750 | $9,500 |

| 5% Transfer Fee | $237.50 | $475 |

| Total Transfer Amount | $4,987.50 | $9,975 |

| Maximum Transfer Amount | $4,762.38 | $9,523 |

How Often Does Discover Offer Balance Transfers

Discover offers balance transfers throughout the year for both new and existing cardholders. This feature allows you to move debt from other credit cards to your Discover card, often with favorable terms.

Let’s explore how Discover handles balance transfers and what you need to know.

Availability for New Applicants

When you apply for a new Discover card, you’ll likely see balance transfer offers. These offers are part of the card’s benefits and can help you save money on interest.

The terms, such as the length of the 0% APR period and the transfer fee, are clearly stated in the card’s details.

Options for Existing Cardholders

If you already have a Discover card, you may receive balance transfer offers from time to time. These offers can appear in your online account, arrive by mail, or be sent via email.

Discover tailors these offers based on your account history and credit profile.

Checking for Offers

To see if you have any balance transfer offers:

- Log into your Discover online account

- Look for a “Balance Transfer” or “Offers” section

- Review any available offers and their terms

If you don’t see any offers online, you can call Discover’s customer service to ask about current balance transfer options.

Terms and Conditions

Balance transfer terms can vary. Common features include:

- A 0% intro APR period (often lasting several months)

- A balance transfer fee (usually a percentage of the transferred amount)

- A limit on how much you can transfer

Remember, the specific terms depend on your creditworthiness and Discover’s current promotions.

Timing of Offers

While Discover provides balance transfers year-round, they may run special promotions at certain times. These promotions might offer longer 0% APR periods or lower transfer fees. Keep an eye out for these enhanced offers, especially if you’re planning to transfer a large balance.

Best Balance Transfer Credit Cards 2024 – Top 10 Cards for 0% Interest on Transferred Balances

Balance transfer credit cards can be a powerful tool for managing debt. In 2024, several cards offer 0% interest on transferred balances, helping you save money and pay off debt faster. Let’s look at the top 10 balance transfer cards this year.

| Card Name | Intro APR Period | Annual Fee | Key Feature |

|---|---|---|---|

| Discover It Balance Transfer | 18 months | $0 | Cash back rewards |

| Citi Diamond Preferred | 21 months | $0 | Extended warranty |

| Chase Slate Edge | 18 months | $0 | Auto credit line review |

| Wells Fargo Reflect | Up to 21 months | $0 | Cell phone protection |

| U.S. Bank Visa Platinum | 20 billing cycles | $0 | Flexible payment date |

| BankAmericard | 21 billing cycles | $0 | Online banking tools |

| Capital One Quicksilver | 15 months | $0 | Cash back on all purchases |

| Citi Double Cash | 18 months | $0 | Cash back on purchases and payments |

| Amex EveryDay | 15 months | $0 | Rewards points |

| Navy Federal Platinum | 12 months | $0 | Low ongoing APR |

Frequently Asked Questions

What is the credit limit on Discover balance transfer?

Discover doesn’t set a fixed credit limit for balance transfers. Your limit depends on your creditworthiness. Credit limits typically range from $500 to over $10,000, based on factors like your credit score, income, and payment history.

Is there a credit limit on balance transfers?

Yes, Discover imposes a credit limit on balance transfers. This limit is usually equal to your overall credit limit, minus any existing balance and fees. For example, if your credit limit is $5,000 and you have a $1,000 balance, you could transfer up to $4,000.

Does Discover have a transaction limit?

Discover doesn’t set specific transaction limits. You can make purchases up to your available credit limit. However, large or unusual transactions may trigger a security check to prevent fraud.

What is the minimum credit limit for Discover it?

The minimum credit limit for the Discover It card is $500. This applies to all versions of the card, including the Balance Transfer option. Even applicants with lower credit scores may qualify for this minimum limit.

What’s the highest Discover credit limit?

Discover doesn’t publicly disclose a maximum credit limit. Some cardholders report limits exceeding $20,000 or even $30,000. However, such high limits are typically reserved for those with excellent credit scores, high incomes, and a strong history with Discover.

Can I request a credit limit increase on my Discover It Balance Transfer Card?

Yes, you can request a credit limit increase through your online account or by calling Discover’s customer service. It’s best to wait 6-12 months after opening your account before requesting an increase. Discover may perform a soft credit check to evaluate your request

Is the initial loan limit fixed or does it change over time?

The initial credit limit is not fixed. It can change over time based on your payment history, credit utilization, overall credit score, and income changes. Discover regularly reviews accounts and may offer automatic increases to responsible cardholders.

Can I request a credit limit increase on my Discover It Balance Transfer Card?

To increase your credit limit chances, consistently pay on time, keep balances low, and use your card regularly. Improve your credit score, update income if it rises, and maintain good financial habits. Discover rewards responsible credit use with potential limit increases over time.